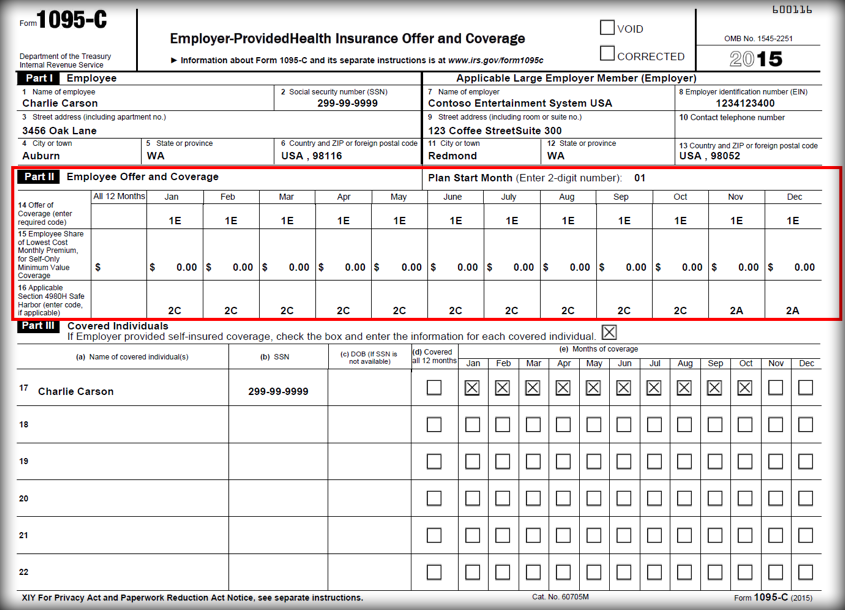

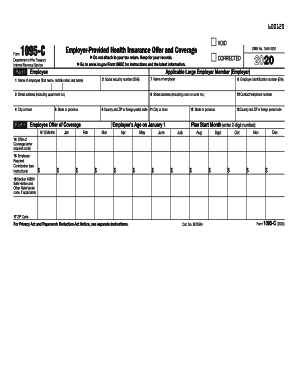

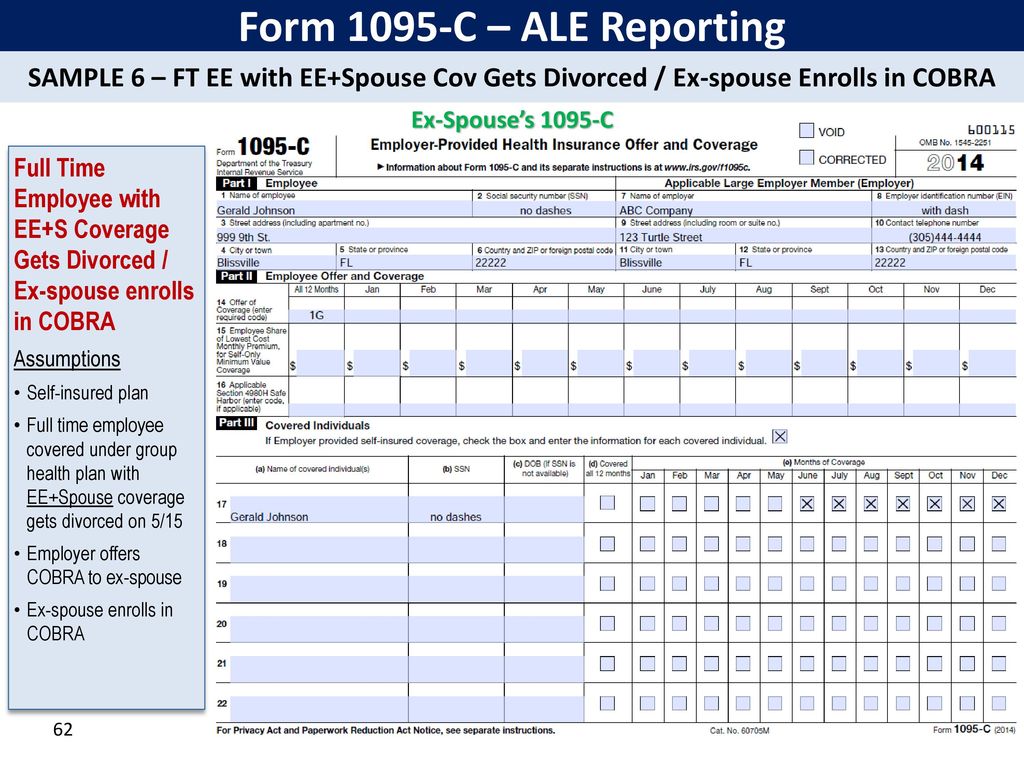

The Form 1095C is the EmployerProvided Health Insurance Offer and Coverage, designed by the IRS to capture enough information about the employer's offer of For example, if an employee is offered coverage for plans that begin in January and July, the employee's Form 1095C plan start month box should be completed with 01 If there is no plan under which coverage is offered to the employee, 00 should be entered in In this case, the employee's 1095C form will show their insurance status up to their termination month, and then change to a 1H/2A (No Offer of Coverage/NotEmployed) status for the remainder of the year In this example, the fulltime employee was insured from January through April, at which time they termed

Employee Benefits Administration Software Isolved Simplify Your Solution

1095-c examples 2020

1095-c examples 2020- IRS Reporting Tip #2, Form 1095C, Line 14, Code 1A versus 1E, and When To Use 1I 6055/6056 Reporting, Affordable Care Act (PPACA), Compliance Alert, Employer Mandate Under the Patient Protection and Affordable Care Act (ACA), individuals are required to have health insurance, while applicable large employers (ALEs) areForm 1095C Decoder If you were a fulltime employee working 30 or more hours per week or enrolled in healthcare coverage from your employer at any point in , you should receive a Form 1095C If you received a Form 1095C from your employer and you're not sure what the codes mean, check out our 1095C Decoder to learn more

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

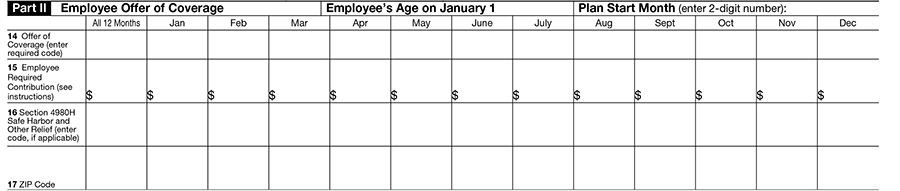

Form 1094C and Form 1095C are IRS forms that employers must file if they are required to offer their employees health insurance under the Affordable Care Act (ACA) The primary difference between these two forms is that Form 1095C includes health insurance information and is provided to the IRS and employeesIRS Form 1095C Indicator Codes for Lines 14, 15, and 16 Form 1095C, Part II, Line 14 Indicator Code Series 1 for "Offer of Coverage" 1A Qualifying Offer Minimum essential coverage providing minimum value offered to fulltime employee with employee contribution for self only coverage equal to or less than 95% mainland singleDivided by 12) See the Instructions for Forms 1094C and 1095C for more details The amount reported on line 15 may not be the amount you paid for coverage if, for example, you chose to enroll in more expensive coverage such as family coverage Line

From the Affordable Care Act Reporting Workshop cosponsored by MedBen and Five Points ICT, presented on This segment includes informationForms 1095C if you had multiple employers during the year that were Applicable Large Employers (for example, you left employment with one Applicable Large Employer and began a new position of employment with another Applicable Large Employer) The IRS has started to issue a new round of ACA penalties that focus on failure to distribute 1095C forms to employees and to file 1094C and 1095C forms with the federal tax agency by required deadlines These are penalties in addition to penalties for not offering the required healthcare coverage

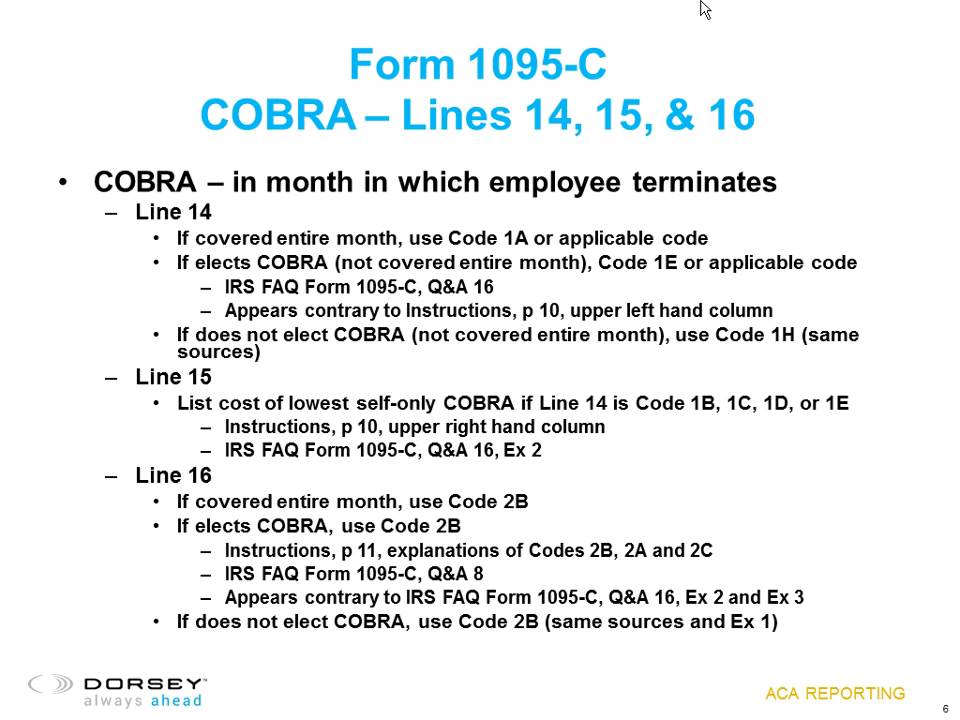

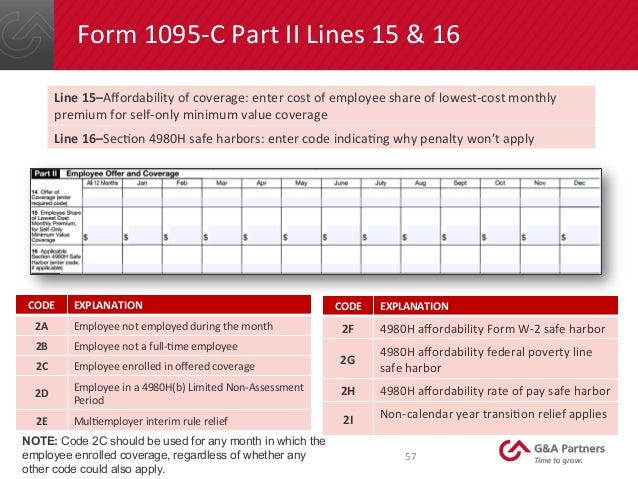

FORM 1095C, LINES 14 16, CODING EXAMPLES Listed, below, are Form 1095C coding directions for various scenarios For purposes of these scenarios, we will assume that, pursuant to its enrollment guidelines, the city or town provides coverage to an ACA fulltime employee on her/his first day of employment and terminates17 Form 1095C (employee statement) Due 17 Form 1094C (transmittal form with copies of Forms 1095C) Due (or , if filing electronically) The 18 forms (ie, forms reporting calendar year 18 information) are due as follows 18 Form 1095C (employee statement) DueCode Series 2 for Form 1095C, Line 16 Line 16 of IRS Form 1095C lists a code that describes, for each month in the previous year, the kind of coverage that an employee enrolled in, and how the employer meets the employer shared responsibility "Safe Harbor" provisions of Section 4980H Below is a description of the various codes in Code Series 2

Irs Form 1095 C Codes Explained Integrity Data

2

1095c examples Fill out blanks electronically using PDF or Word format Make them reusable by generating templates, add and fill out fillable fields Approve documents by using a lawful electronic signature and share them by way of email, fax or print them out Save blanks on your laptop or mobile device Boost your productivity with powerful solution? Here are a few more questions from our webinar, "Mastering 1095C Forms for ACA Compliance" If you missed the webinar, you can replay it hereThese questions cover measurement and stability periods, Union questions, waiting periods, and specifics on the forms1095 C Form Example Form 0440 SHARE ON Twitter Facebook Google 21 Posts Related to 1095 C Form Example 1095 C Form Aca Form 1095 1095 C Form Codes 1095 C Form Instructions How Do I Print My 1095 A Form Print 1095 A Form Print 1095 A Tax Form Print Irs Form 1095 A

Irs Form 1095 C Codes Explained Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

18 1095C Codes For more information (for example, the code for a section 4980H affordability safe harbor) except as provided below Do not enter code 2C in line 16 for any month in which the multiemployer interim rule relief applies (enter code 2E)Prior Year Products Enter a term in the Find Box Select a category (column heading) in the drop down Click Find Click on the product number in each row to view/download Click on column heading to sort the list You may be able to enter information on forms before saving or printing1095c examples Reap the benefits of a electronic solution to develop, edit and sign contracts in PDF or Word format on the web Turn them into templates for multiple use, add fillable fields to gather recipients?

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Code Series 1 For Form 1095 C Line 14

1095C submissions and corrected IRS Form 1095C submissions – they need to be transmitted separately Our application allows you to select between Original and Corrected •It is possible to submit a corrected IRS Form 1094C without any corresponding IRS Form 1095C–for example •Total employee count was wrong for a month Form 1095C compliance isn't always easy, but it definitely doesn't have to be difficult From what it is and how reporting works to updates for the new year and common employee FAQs, find out what HR and employers need to know about Form 1095C What is Form 1095C?Line 16 Codes of Form 1095C, Safe Harbor IRS designed the Code Series 2 indicator codes from 2A to 2I to determine affordability For example, if a 2H is entered, this indicates that the employer used the Rate of Pay Safe Harbor to determine the affordability Click here to learn more about ACA Form 1095C Line 16 Codes

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Affordable Care Act Aca Ability To Generate 1095 B And 1095 C Forms Microsoft Dynamics Ax Community

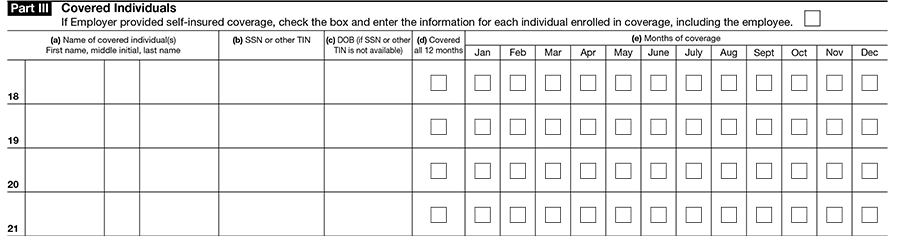

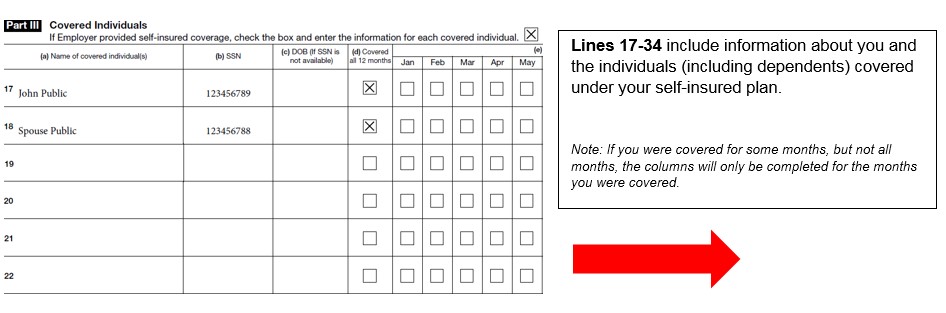

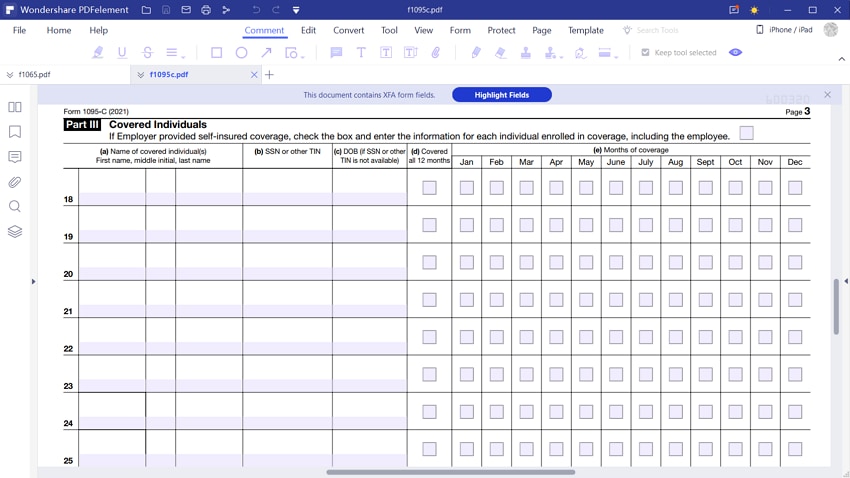

You'll send 1094C and 1095C to the IRS, and you'll also give a personalized copy of the 1095C to every single person on your team 3 Which brings us to the next point — there's a good reason for you to fill them out The entire reason these forms exist is to show the IRS that you're providing your team with meaningful health careForm 1095C is divided into three parts Part I is used to identify the employee, and the reporting ALE entity It includes demographic information such as name, contact and demographic information, Social Security Number (SSN) and Employer Identification Number (EIN)Line 14 of Form 1095C is used to report information about the coverage offered throughout the year The offer of coverage made to an employee for each month of the year includes health insurance coverage offered or not and the type of coverage The IRS has designed sets of codes 1A to 1K which describes the offer of coverage

1095 C 1094 C Aca Software To Create Print E File Irs Form 1095 C

Www Irs Gov Pub Irs Prior F1095c 15 Pdf

Data, put and ask for legallybinding electronic signatures Do the job from any gadget and share docs by email or fax Check out now?The Form 1095C includes information about the health insurance coverage offered to you and, if applicable, your family You may receive multiple Forms 1095C if you worked for multiple applicable large employers in the previous calendar year You may need to submit information from the form (s) as a part of your personal tax filing Form 1095C Employee Questions Answered 15 marks the first year applicable organizations are required by law to file Forms 1094C and 1095C As a result, many employers have spent the bulk of their time huddled away in offices learning the ins and outs of each form to ensure yearend filings meet the Internal Revenue Service's

Aca Reporting Tackling Complex Form 1095 C Situations And Preparing For Form 1094 C Youtube

Www Irs Gov Pub Irs Pdf P5165 Pdf

B1 Understanding the Sources for Forms 1095C and 1094C and1095C XML The Form 1095C print and the 1094C or 1095C XML files are handled through the JD Edwards Electronic Document Delivery (EDD) system The system uses the data item aliases during the spool file batch export step to create XML source files, which are then used to map the information to When populating Form 1095C, employers are communicating a lot of information through a series of codes on Lines 14 and 16 It is incredibly important for an employer to have documentation supporting the codes they are using when populating the Forms 1095C Below is a general breakdown of the different codes that could be entered on Lines 14 and 16 of Form 1095CInstructions and Help about 1094c example So there's a few things that I wanted to go over and then I'm going to end with a little pop into the systems that we can show you all how to approve and create all of your 1095 and your 1084 so we'll do a few things today but if you have keeping things aside for those of you who haven't join us on a winner there is a chat feature to your bottom left

Form 1095 A 1095 B 1095 C And Instructions

Irs Form 1095 C Codes Explained Integrity Data

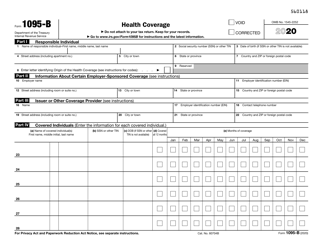

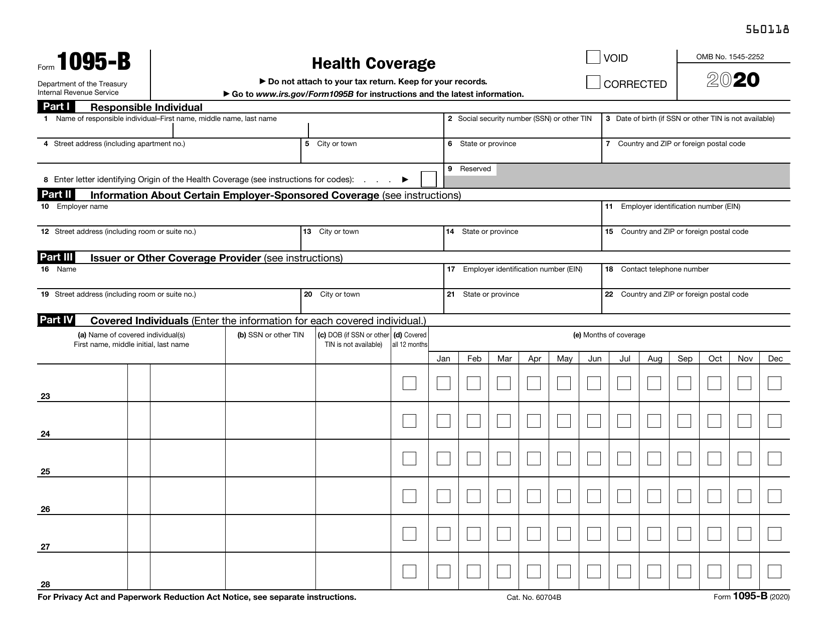

Below is Form 1095C from the IRS website This guide will explain each piece of the form and help you determine the proper codes for the fields in Part II Shown below in blue, Parts I and III are comprised of lines 113 and 1734, respectively These sections are easy enough, just employee informationForm 1095B, Health Coverage, should come in the mail if you purchased or received insurance outside of an exchange Form 1095C, EmployerProvided Health Insurance Offer and Coverage, is required by companies who meet the qualifications to be considered Applicable Large Employers This includes employers with 50 or more fulltime employees in Form 1095‐C Examples Revised Gallagher Benefit Services ALE1 Webinar Presentation Part II Examples (10‐3‐18) IRS Reporting Resource Guide Examples for VEHI Members Example 1

Ez1095 Software How To Print Form 1095 C And 1094 C

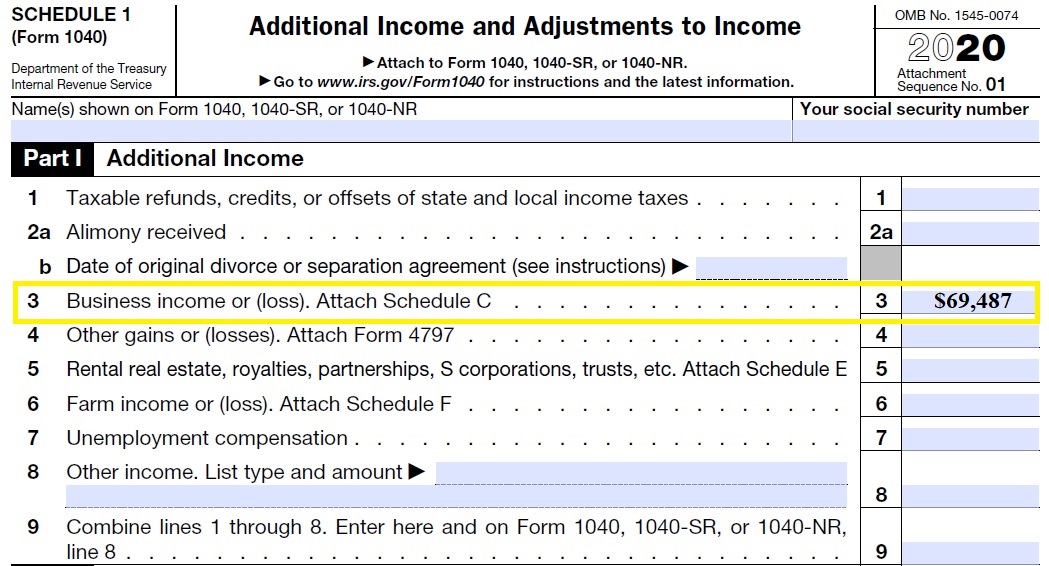

Irs Schedule C Instructions For 1099 Contractors Shared Economy Tax

The Form 1095C is an IRS form created when the Affordable Care Act (ACA) was implemented, and that must be distributed to all employees describing their health insurance cost, opportunities, and enrollment According to the ACA, certain companies must provide an option for health insurance to their employees if the companies are ApplicableHow to complete Form 1095C In order to stay compliant with the Affordable Care Act in 16, companies with a fulltime staff of 50 or more will need to file a Form 1095C for each employee We'll help you figure out how it worksForm 1095 C Employee Communication (50 Fully Insured Plan) HR360's sample letters include Explanations of why the employee is receiving Form 1095C Information included in the Form 1095C (including an explanation of Part III for selfinsured plans) Descriptions of why an employee may receive multiple Forms 1095C

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Irs Tax Forms Wikipedia

Key Points about completing Form 1095C You have until to deliver Form 1095C to your employees The codes you use to complete these forms depend on the coverage you offer, whether your employee enrolls, and other employment changes We outline common example scenarios to help you choose the appropriate codes for lines 14 and 16 1095c examples – Fill Online, Printable, Fillable Blank By admin 16 July, 21 Updated 28 July, 21 No Comments 8 Mins Read Facebook Twitter The 1094C must be filed with the Form 1095C, but it acts as a sort of cover sheet that sums up all the 1095Cs As stated above, the primary goal for the IRS with these forms is to determine whether you have satisfied the Employer Mandate, whereby you offer sufficient insurance If you don't satisfy the Employer Mandate, there are fines

How To Get 1095 A Form From Health Connector

Common 1095 C Coverage Scenarios With Examples Boomtax

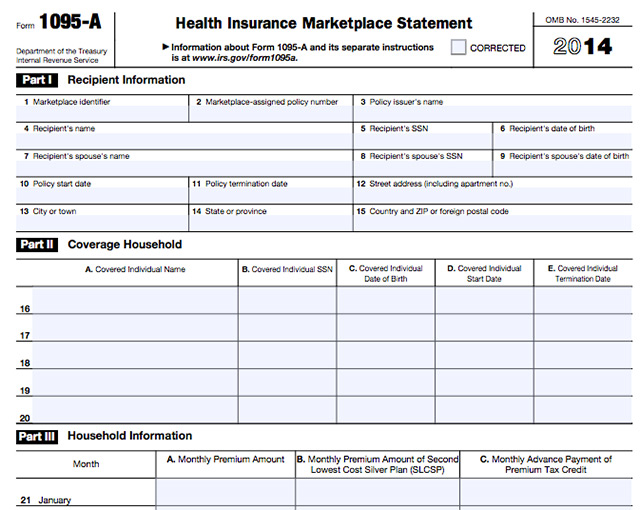

form 1095a sample You can not receive all 3 forms As a customer, you do not need to produce this form because you are made by an insurance company Those interested in Obamacare prizes will end up being a huge problem for tax payers You may not have received the form because you have not456 1094C and 1095C Sample Instance 19 456 1094C and 1095C Sample Instance 19 457 1094C and 1095C Business Rules 457 1094C and 1095C Business Rules 46 Federal and State Differences XML Schemas 46 Federal and State Differences XML SchemasSample 1095 C form for Year and later Sample 1095 C form for Year 15 to 19 Troubleshooting;

Affordable Care Act 1 Properly Reporting Cobra Continuation Coverage Integrity Data

Common Mistakes In Completing Forms 1094 C And 1095 C

Q1 Cannot import data from file or file with bad data; FullTime Employee Hired Midyear In this example, the employee (EE) was hired as a fulltime employee (FTE) on April 10 th and is eligible for coverage on the first of the month after the Limited NonAssessment Period (LNAP) of 30 days (June 1 st) Even if the ALE files the 1094C/1095C late, it still might trigger an employer shared responsibility payment (ESRP) assessment based on the information filed on the 1094C/1095C If the information filed on those forms is accurate, then the ESRP assessment would be the correct amount the employer owes the IRS under the provision

Ez1095 Software How To Print Form 1095 C And 1094 C

/ScreenShot2021-02-11at3.31.52PM-d4cdbd3f5e984eebb91c2b0478e46dc2.png)

Form 1095 C Employer Provided Health Insurance Offer And Coverage Definition

Creating the 1095C spreadsheet to be imported Although you can create your own spreadsheet to import 1095C information for your clients' employees, we recommend that you use the 1095C template spreadsheet that we have made available for exportThe 1095C template spreadsheet exports from Accounting CS populated with basic employee information that is formatted to match the Sample 1095C Form 1095A, 1095B, 1095C, and Instructions The 1095 forms are filed by the marketplace (1095A), other insurers (1095B), or by your employer (1095C) We have simple instructions for the 1095 forms Keep in mind the 1095 forms are filed by whomever provided you coverage, so individuals won't have to fill them out themselvesThe Affordable Care Act (ACA) requires all Applicable Large Employers (ALEs) to offer

Common 1095 C Coverage Scenarios With Examples Boomtax

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Answer 11 Please test with our sample data file (Please follow the step 2 in this guide)Example An employee who passes a fulltime test date of 11/1/19, with a Stability Start Date of 1/1/, would receive a Form 1095C for 19 On the form, the line 14 code would be 1H (no offer of benefits) for November and December 19, and the line 16 would be 2D (indicating the employee is in a waiting period)

Form 1095 C The Aca Times

9 Aca Affordable Care Act Software Ideas Irs Forms Tax Forms Efile

Employee Benefits Administration Software Isolved Simplify Your Solution

Employers Are You Unsure Of The Coding On Forms 1094 C And 1095 C The Aca Times

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Irs Form 1095 B Download Fillable Pdf Or Fill Online Health Coverage Templateroller

2

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Updated Affordable Care Act Form 1095 C Methodist Health System

1095 C Corrections Support Center

Www Irs Gov Pub Irs Prior F1095c 18 Pdf

1094 C 1095 C Software 599 1095 C Software

Irs Form 1095 C Codes Explained Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

2

Preparing For The Affordable Care Act In 16

Aca Reporting Preparing For 16 Deadlines Aca Reporting Preparing For 16 Deadlines Bradley Arends Alliance Benefit Group Financial Services Corp Ppt Download

1095 C Print Mail s

Form 1095 C Faq Millennium Medical Solutions Inc

Setting Up Aca Information Returns Workfiles

1

Form 1095 C Examples Shefalitayal

Accurate 1095 C Forms Reporting A Primer Integrity Data

Form 1095 A 1095 B 1095 C And Instructions

Aca Reporting Penalties Newfront Insurance And Financial Services

Sample 1095 C Forms Aca Track Support

Form 1095 A 1095 B 1095 C And Instructions

1095 C 15 Pdf

Irs Form 1095 C Instructions For 21 Step By Step Filing Guide

Common 1095 C Coverage Scenarios With Examples Boomtax

Aca Codes A 1095 Cheat Sheet You Re Gonna Love Thread Hcm

Form 1095 C Forms Human Resources Vanderbilt University

Ez1095 Software How To Print Form 1095 C And 1094 C

Irs Issues Draft Form 1095 C For Aca Reporting In 21

Fillable Form 1040 Schedule C 19 In 21 Irs Tax Forms Credit Card Statement Tax Forms

Form Irs 1095 C Fill Online Printable Fillable Blank Pdffiller

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

New Form 1095 B 17 Models Form Ideas

Aca Employer Reporting Requirements 1094c 1095c Efile4biz

/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

1

1

Accurate 1095 C Forms Reporting A Primer Integrity Data

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Common 1095 C Coverage Scenarios With Examples Boomtax

Form 1095 C Forms Human Resources Vanderbilt University

1095 C Faqs Office Of The Comptroller

Vehi Org Client Media Files Ale Webinar Presentation Part Ii Examples10 3 18 Pdf

Aca Code 1a Alert Irs Clarifies 1095 C Guidance For A Qualifying Offer Integrity Data

Irs Form 1095 C The Best Way To Fill It Out Wondershare Pdfelement

Common 1095 C Coverage Scenarios With Examples Boomtax

Accurate 1095 C Forms Reporting A Primer Integrity Data

Updated Sample Employee Letters For Irs Forms 1095 B And 1095 C Kistler Tiffany Benefits

Aca Code Cheatsheet

2

Accurate 1095 C Forms Reporting A Primer Integrity Data

File Taxes For Obamacare

Good Sense Guide To Minimum Essential Coverage Forms 1094 C And 1095 C California Benefit Advisors Johnson Dugan

:max_bytes(150000):strip_icc()/1095b-741f9631132347ab8f1d83647278c783.jpg)

Form 1095 B Health Coverage Definition

Irs Form 1095 C Codes Explained Integrity Data

Q Tbn And9gcsj2fd0y5g6r8mt9bhze7eiq3dikiuy6ur5pdhj7m9zdqnm8y O Usqp Cau

Health Insurance 1095a Subsidy Flow Through Irs Tax Return

Form 1095 A 1095 B 1095 C And Instructions

Irs Affordable Care Act Reporting Forms 1094 Ppt Download

Www Irs Gov Pub Irs Prior Ic 17 Pdf

Common 1095 C Coverage Scenarios With Examples Boomtax

Irs Form 1095 B Download Fillable Pdf Or Fill Online Health Coverage Templateroller

Accurate 1095 C Forms Reporting A Primer Integrity Data

Common 1095 C Coverage Scenarios With Examples Boomtax

Common 1095 C Coverage Scenarios With Examples Boomtax

How To Choose Form 1095 C Codes For Lines 14 16 Aps Payroll

1095 C Form 18 Awesome Examples Resumes 17 Basic Resume Model Gallery Resume Format Models Form Ideas

Help How Do I Report Self Employment Income For Medicaid Or The Marketplace Healthcare Counts

Http Www Healthreformbeyondthebasics Org Wp Content Uploads 16 03 Premium Tax Credit Tips And Tricks Pdf

18 Complyright 1095 C Employer Provided Health Insurance Offer And Coverage Form And Envelopes Bundle For 500 Employees Amazon Sg Office Products

Accurate 1095 C Forms Reporting A Primer Integrity Data

Aca Code Cheatsheet

0 件のコメント:

コメントを投稿